Why are certain waste so popular in international waste shipment?

Why plastic, paper, and metal waste—are so highly sought after? What pushes some countries to import huge quantities of waste from others, and how do they turn what’s unwanted into something indispensable? This article unpacks the fascinating story of Europe’s waste transport industry, exploring the surprising statistics, the motivations fueling this trade, and the challenges it faces. Behind the scenes, this quiet industry plays a vital role in shaping a greener, more sustainable future.

International waste shipment – overview

Plastic, paper, and metal scrap are the heavyweights of Europe’s waste transport system. Their journey across borders isn’t random; it’s a strategic effort to match waste generators with countries that have the capacity and expertise to recycle them efficiently.

- Take plastic waste, for instance. Europe generated about 16.1 million tonnes of plastic waste in 2022, with most of it transported internationally for recycling. The bulk of this waste comes from packaging—think bottles, bags, and wrappers. Despite the challenges of plastic recycling, its versatility and growing demand for recycled materials make it a critical player in the waste transport scene.

- Meanwhile, paper waste tells a story of success in recycling. With almost 35 million tonnes of paper and cardboard waste produced in 2022, nearly 1/3 of it crossed borders for processing. From newspapers to corrugated boxes, paper waste is a staple of recycling programs, contributing to Europe’s impressive paper recovery rates.

- Finally, there’s metal scrap, the backbone of many industries. In 2022, Europe transported about 18 million tonnes of metal scrap across borders. Steel, aluminum, and copper from construction debris, old appliances, and vehicles are repurposed into raw materials for new products, saving energy and reducing the need for mining.

These materials’ international movement isn’t just about clearing waste; it’s about creating value and fueling industries that rely on recycled resources.

International waste shipment – destinations

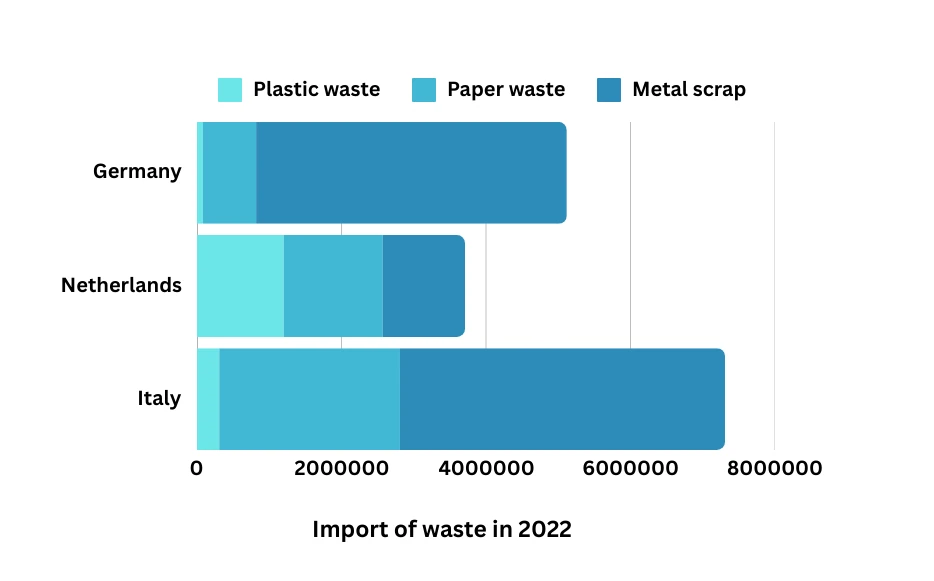

Europe’s recycling powerhouses rely on imported waste to keep their industries thriving. Countries like Germany, the Netherlands, and Italy don’t just process their own waste—they take in large volumes from neighbors, turning it into raw materials for manufacturing.

Germany

Germany, for example, imported over 80,000 tonnes of plastic waste in 2022. It’s not because Germany can’t manage its own waste; rather, its state-of-the-art recycling facilities have the capacity to handle more. The processed plastic is turned into high-quality pellets for industries like automotive and packaging. Germany also brought in 738,400 tonnes of paper waste, feeding its massive paper mills, and 4.3 million tonnes of metal scrap, fueling its industrial and construction sectors.

Netherlands

In the Netherlands, a hub of waste management innovation, 1.2 million tonnes of plastic waste were imported in 2022, according to United Nations Comtrade Database. Much of this waste goes into advanced chemical recycling plants, producing materials for packaging and consumer goods. The Netherlands also imported 1.37 million tonnes of unbleached kraft paper or paperboard waste. The country have also imported $433M worth of scrap metal which – given the average price of $380 per tonne of scrap at the time, gives over 1.1 million tonnes.

Italy

Italy is a key player in Europe’s recycling landscape, particularly when it comes to metal scrap. According to the Italian trade association Assofermet, in 2022, Italy’s steel enterprises utilized approximately 19 million tonnes of ferrous scrap. Of this total, about 12.5 million tonnes originated domestically, while 4.5 million tonnes were imported from other European Union countries. Additionally, only 607,000 tonnes (3.2%) were imported from non-EU countries. The country’s advanced recycling facilities also processed 2.5 million tonnes of imported paper waste. Then it transformed it into materials for packaging and other paper products. The country imported approximately 308,700 tonnes of plastic waste in 2022. This estimation is based on the import value of $140 million and the average price of secondary plastic materials in the EU, which was €454 per tonne in 2022.

These countries don’t just treat waste as a problem—they see it as an opportunity. By importing and recycling waste, they reduce the need for virgin resources, cut energy consumption, and support a circular economy.

Challenges in international waste shipment

Despite the success stories, waste transport isn’t without its challenges. Moving waste across borders means navigating a maze of regulations, ensuring compliance with strict environmental standards, and maintaining the quality of recyclable materials. Add to this the complexity of logistics and the potential for contamination during transit, and it’s clear why waste transport requires expert handling.

For companies dealing with these challenges, finding reliable waste carriers can be a daunting task. That’s where organizations like the Ekologistyka24 Group step in. They provide expert advice and maintain a comprehensive database of certified waste transporters, making it easier for businesses to connect with trusted partners. Their services ensure smoother operations, compliance with regulations, and the safe delivery of recyclable materials to their destinations.

By streamlining the waste transport process, Ekologistyka24 Group is helping Europe achieve its sustainability goals one shipment at a time. Are you in need of waste transport permit? Or maybe you’re looking for available loads to